What does this mean for home buyers?

It is easy when shopping to look only at the price tag: it is right there, in front of your face. But, if you use a credit card, there is that hidden price tag that nobody wants to think about: interest. I dislike interest so much that I don’t even have a credit card, and I never have. (Yes, I know that using a card responsibly can help establish credit.)

It’s the same with a house. Of course, you have to consider the sale or purchase price of a home that you can afford. But, you also have to think about that other price tag: the interest rate of your loan.

The truth is, purchasing a home is a long term decision, and can be complicated with changing home values and changing interest rates. If you are not paying cash for a home, the price of the loan is probably equally important as the price of the home itself.

Right now, interest rates are the lowest they have been, in history. What does that mean to you, as a buyer?

Home loans have gone on sale.

Think of the cost of purchasing a pair of pants with a credit card as the price of your interest, plus the ticket price you pay at the store. Then, there are two ways those pants can go on sale. One is, the store can have a sale and reduce the ticket price. The other way is a decrease in your interest.

When home interest rates go down, it means that you have to pay the bank (or other lender) less each month to borrow money the same amount of money. Sort of like a giant home sale.

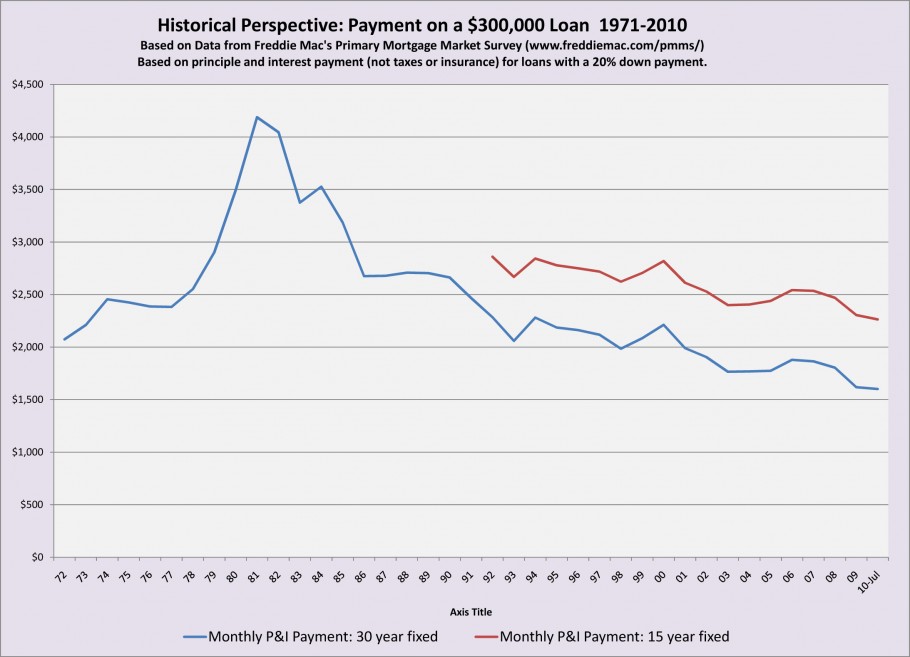

For example, one of our Exclusive Buyer’s Agents used an example of a home buyer with a $300,000 home loan. The monthly payment for this loan depends on the interest rate.

For example, if you got a home loan of $300,000 in the early ’80’s, you would pay just over $4,000/month for your mortgage payment.

For a home loan of $300,000 now, your mortgage payment would be about $1,600/ month.

A change in interest rate in this example results in a $2,400 monthly difference. By anyone’s standards, that is a lot of money.