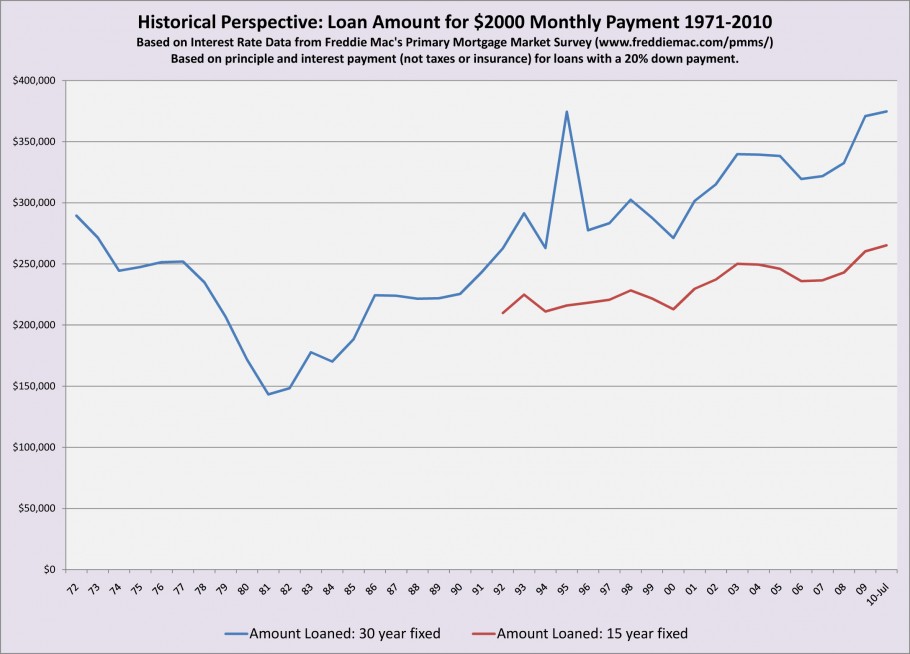

One of our exclusive buyer agent’s also created another interesting chart showing a different perspective on what dropping interest rates mean for home owners’. How much of a loan can you get for $2,000 per month? In other words, for $2,000 a month, for 30 years, what can you buy?

Your monthly mortgage payment is made up of principal and interest. If the interest portion goes way down, the principal portion can go up without adding anything to your monthly payment. In other words, you could qualify for a larger loan, and buy a better house, for the same monthly payment.

If we look at the chart, a $2,000 loan in the early 1980s could pay for just about a $150,000 loan. Including a 20% down payment, that’s an $187,500 house.

Now, a $2,000 loan can pay for about a $375,000 loan. Including a 20% down payment, that’s a $468,750 house.

Things get more complicated than I really care to get into if you were to take into account things like inflation, changes in average income, the birth of the iPhone (just kidding, for once the iPhone has nothing to do with it). But, let’s say all these things were equal, and the only difference was the interest rate.

You could buy a home now worth more than twice the home you could have bought in the 80s, for the same $2,000 per month. That’s a lot of square footage. That’s a lot of granite countertops. Or a swanky location, or updated master bath.

So the difference between the 80’s and today is the difference between a cute starter townhouse and a luxury home with a mountain view. And, jean jackets and “scrunchies” were in style.

If it’s such a great deal, why aren’t people buying homes left and right? Loans are tough to come by with stricter underwriting. People are taking home buying really seriously. For some, it’s just not economically possible.

But, if it is time for you to home shop, lucky you- you will probably be able to get a great deal.